Easy to Find a Fast Online Payday Loan for Emergency Situation Money

Easy to Find a Fast Online Payday Loan for Emergency Situation Money

Blog Article

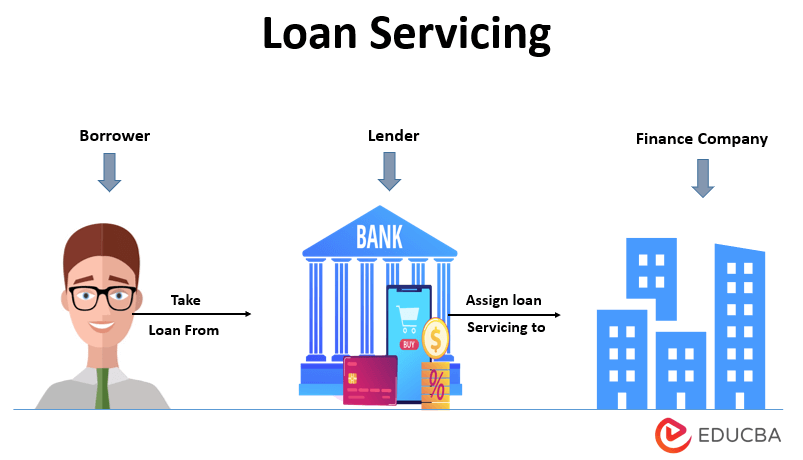

Secure Your Future With Tailored Online Loans From Professional Lending Provider

Tailored online lendings used by professional lending services have come to be a popular option for individuals looking for economic help. How can you make sure that you are maximizing the potential of your on the internet funding to attain long-term success? Let's discover the important methods and considerations that can assist you make the most of your tailored online financing and set on your own up for a thriving future.

Advantages of Tailored Online Loans

Customized online finances offer a myriad of advantages for people looking for individualized monetary remedies in today's electronic age. With on-line financing services, consumers can apply for lendings from the convenience of their homes or offices, eliminating the demand to check out physical branches.

Additionally, customized on the internet lendings frequently feature quick approval processes. By leveraging electronic innovation, lenders can accelerate the confirmation and authorization procedures, allowing consumers to accessibility funds in a timely fashion. This quick turnaround time can be essential for individuals dealing with immediate unexpected expenditures or monetary demands.

How to Pick the Right Car Loan Solution

Offered the range of customized online finance options offered today, selecting the best car loan solution that straightens with your certain financial requirements calls for careful factor to consider and notified decision-making. To start, determine your economic objectives and the objective of the loan. Recognizing just how much you need to obtain and of what specific factor will assist limit the choices readily available.

Next, compare interest rates, fees, and payment terms from different loan services. In addition, examine the level of client support used by the financing service, as having accessibility to responsive aid can be critical throughout the financing procedure.

Additionally, evaluate the versatility of the funding service in terms of settlement options and potential extensions. Ensure that the finance service aligns with your economic abilities and gives a settlement strategy that matches your spending plan. By taking these elements into account, you can make a notified choice and select the appropriate finance solution that best fits your financial demands.

Understanding Car Loan Conditions

Understanding the complexities of lending conditions is necessary for customers seeking to make educated monetary decisions. Finance terms and conditions describe the specifics of the agreement in between the debtor and the lending institution, including the funding quantity, rate of interest, settlement routine, fees, and any type of other pertinent information. Online payday loans. It is important for debtors to very carefully assess and understand these terms before consenting to a funding to prevent any kind of shocks or mistakes down the line

One secret element of financing terms is the rates of interest, which identifies the price of obtaining cash. Customers ought to pay attention to whether the rates of interest is fixed or variable, as this can influence the total quantity settled over the life of the funding. Additionally, recognizing any fees related to the funding, such as origination charges or early repayment penalties, is vital for budgeting and planning purposes.

Steps to Protect Your Online Loan

Before continuing with securing an online loan, consumers need to first guarantee they extensively understand the terms and conditions described by the lending institution. It is vital to have these documents conveniently available to speed up the car loan application procedure.

After gathering the required documentation, customers ought to look into various finance choices available to them. When an ideal lending choice is picked, the application procedure can begin.

Maximizing Your Financing for Future Success

To utilize the complete possibility of your car loan for future success, tactical economic planning is crucial. Begin by detailing clear purposes for exactly how the finance will certainly be used to thrust your monetary ventures forward. Whether it be purchasing further education and learning, increasing your organization, or combining present financial debts, a well-balanced bridging finance strategy is crucial. Make best use of the influence of your finance by thinking about the lasting implications of your financial decisions. Evaluate the rate of interest rates, settlement terms, and potential rois to ensure that the finance straightens with your objectives. In addition, pool loans explore ways to optimize your budget plan to accommodate funding repayments without endangering your financial security. By staying organized and disciplined in your strategy to taking care of the financing, you can set on your own up for future success. Frequently check your progress, make adjustments as needed, and look for assistance from monetary advisors to make educated decisions. With a tactical way of thinking and prudent financial monitoring, your car loan can act as a tipping rock towards attaining your long-term goals.

Final Thought

Finally, tailored on the internet finances from specialist finance services offer many advantages for safeguarding your future financial security. By thoroughly selecting the appropriate finance solution, understanding the conditions and terms, and adhering to the needed actions to secure your funding, you can maximize its capacity for future success. It is crucial to approach on the internet finances with care and make certain that you are making informed decisions to achieve your monetary goals.

Report this page